Nonqualified Deferred Compensation: What Advisors Need to Know

Brian Yolles of StockShield and Jeff Roberts of ADP Executive Deferred Compensation will present on the topic Nonqualified Deferred Compensation: What Advisors Need to Know to Advise Executives on June 18 at the Hilton San Francisco Airport Bayfront.

Many executives and key employees have the opportunity to participate in NQDC plans to put more money away than they can under the limits of tax-qualified retirement and pension plans. This session will address:

- How these plans work to defer compensation, including salary and/or bonus, and the taxes at various stages

- Importance of NQDC in an executive’s overall financial goals and strategies

- Decisions at enrollment on contribution amounts and on distributions, and the role for advisors in helping clients make the best choices

- Risks associated with these plans, including ways to mitigate them

The presentation is part of myStockOptions’ annual conference Financial Planning for Public Company Executives & Directors.

Rapid Collapse of Utility Underscores Need to Manage Risk

PG&E’s California inferno likely to cripple employees' retirement security

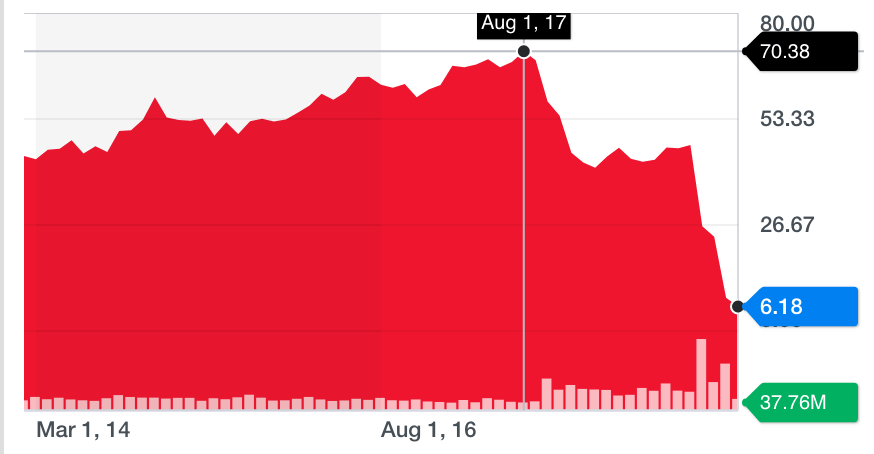

PG&E Corp. stock lost more than half its value yesterday and has traded today for as low as $5, down from its high of $70 per share in 2017 – a loss of more than 90% in 18 months.

In a regulatory filing, PG&E disclosed it will file for Chapter 11 bankruptcy protection. Three of its retirement plans – the Supplemental Retirement Savings Plan (SRSP), Supplemental Executive Retirement Plan (SERP), and Defined Contribution Executive Supplemental Retirement Plan (DC-ESRP) – are likely to experience substantial losses and may be worthless, as participants in these plans acquire status as General Unsecured Creditors (GUC).

PG&E’s financial problems began suddenly and accelerated dramatically after evidence pointed to its role in sparking a wave of historic wildfires in California. While the utility has still not been determinatively deemed the cause of any of the fall 2018 fires, investors have assumed that this is a foregone conclusion and abandoned the stock accordingly.

In an SEC filing, PG&E assessed the extent of its liability (predominantly legal liability resulting from civil lawsuits) resulting from the recent fires. It concluded that were it to be found liable for “certain or all” of the damages with respect to the 2017 and 2018 Northern California wildfires, the amount of such liability could exceed $30 billion – not including punitive damages, fines and penalties.

Even more remarkable, PG&E stated that even its estimate of $30 billion “is not intended to provide an upper end of the range of potential liability arising from the 2017 and 2018 Northern California wildfires, which management is not able to reasonably determine at this time. In certain circumstances, PG&E’s liability could be substantially greater than such amount.”

Over the last three months, PG&E stock has lost more than 80% of its value, causing the company’s valuation to crater to $2.8 billion from a peak of more than $36 billion in 2017.

Not a single analyst or market expert predicted such a precipitous decline. As recently as November 2018, Morningstar Equity Research re-affirmed its $53 per share fair value estimate and stated, “PG&E’s core business continues to track our 6% normalized growth outlook based on $6 billion of annual investment during the next few years. PG&E has substantial growth investment opportunities in distribution upgrades and disaster mitigation work following the new more-aggressive renewable energy standards in Senate Bill 100 and the implementation of SB 901.”

It has been widely believed in almost all corners of the investment community that utility companies are the most conservative stocks one can own, with large dividends and generally low risk of large losses given their conservative business model and recurring revenues.

There is no allegation or evidence that anyone at PG&E intentionally caused any of the fires. The company’s liability is solely based on negligence – and negligence with respect to merely a small percentage of its power lines.

One of the many lessons that can be learned from PG&E’s demise is that a few small negligent errors can decimate any company, no matter how large or long-standing or financially prosperous or seemingly “conservatively” operated and managed. Given how extensive the operations of most large companies today are, how many different business lines and geographical markets to which their reach extends, no executive or group of executives can ever ensure that their company never creates the type of liability that could cause its demise in a very short period of time. Human nature and behavior being what they are, negligent errors can never be eliminated. They can only be reduced, and one can only hope that the errors that ultimately result are not as catastrophic as those involved in the California wildfires.

StockShield designed its capabilities for those who take seriously the lessons offered by PG&E’s demise. Any company can at any time be brought to the brink of bankruptcy simply from a few careless errors on the part of any of its agents – or from events completely beyond the control of the company. Executives, retirees, and other employees who have worked and sacrificed decades of the very best years of their life could, within weeks, lose any realistic chance of realizing the financial resources they are otherwise rightfully due.

Retirement Dreams Up in Flames?

California wildfires cause potential liability of $15 billion

The tragic and deadly Northern California Camp Fire has gained widespread media attention over the past several days. Although the focus has mainly been on the homes destroyed and the tragedy of lives lost, another group that could bear significant damage is the shareholders and executives of Pacific Gas & Electric Company.

As the fire continued to ravage Northern California, media reports began to circulate that the cause of the fire had something to do with a power line owned by PG&E. Soon the reports increased in frequency and legitimacy, culminating in the filing of a lawsuit by a plaintiff’s attorney who contended that the evidence demonstrating PG&E was the initial cause of the fire was “pretty overwhelming.” PG&E for its part was forced to disclose that it had an outage of its power line in virtually the same area the fire began 15 minutes before the fire started.

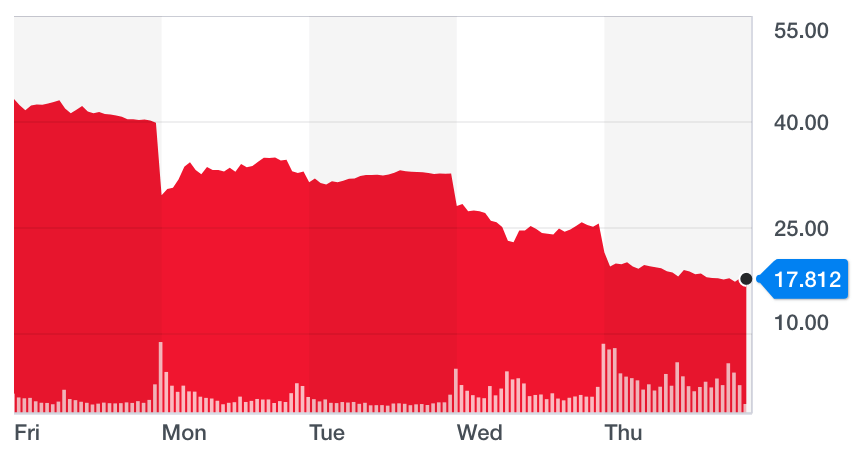

Against this backdrop of unfavorable news, PG&E’s stock (symbol PCG) lost more than half of its value in a single week as shareholders fled the utility amid concerns that its equipment may be responsible for the most destructive wildfire in California’s history. PCG shares plunged nearly 30% on Thursday, November 15, after falling 20% the day prior. The stock traded at around $18 per share as of Thursday afternoon, which is a tremendous decline given that Wall Street price estimates on the stock were north of $65 per share.

Although it has not happened yet, the potential bankruptcy of PG&E is clearly driving the negative price action on PCG this week. If that were to materialize, PG&E executives & retirees could face significant losses associated with their non-qualified deferred compensation (NQDC) accounts sponsored by PG&E. The company’s website indicates that any amount in the deferred compensation account “represents an unsecured claim against the company.”

The lessons to be learned here are obvious and directly relevant to any employee or retiree with a substantial amount in a deferred compensation plan. Even plain “vanilla” utilities like PG&E can unexpectedly suffer catastrophic losses in value very quickly, so quickly that there is no time to do anything to protect oneself from the full consequences of the decline.

StockShield believes the only intelligent and prudent course of conduct is to implement a risk mitigation strategy BEFORE the unknown event materializes and causes a catastrophic decline in a company’s value sufficient to materially increase its bankruptcy risk and wipeout its deferred compensation plan.

Lessons Learned from the Automotive Industry

The bankruptcies of Chrysler and GM offer lessons on how to build and protect wealth

In a recent tweet, Tesla’s CEO Elon Musk explained that he maintains an around-the-clock work schedule because “Ford & Tesla are the only 2 American car companies to avoid bankruptcy.”

This led us to consider the fate of Chrysler and General Motors, members of the “Big Three” that did indeed file for bankruptcy (in 2009).

While Mr. Musk focuses on his work schedule, the primary lesson we derive from these bankruptcies is that, when wealth is concentrated in a single company, the risk of that concentration must be carefully managed.

In addition, it is important not to overlook the risk in Non-Qualified Deferred Compensation (NQDC) retirement plans. These plans are unsecured and unfunded “promises to pay” from the sponsoring company.

For example, the “new” GM currently offers at least one such plan, noting that:

All amounts deferred under the Plan shall remain the sole property of the Company, subject to the claims of its general creditors and available for use by the Company for whatever purposes are desired. With respect to amounts deferred, a Participant shall be merely a general creditor of the Company and the obligation of the Company hereunder shall be purely contractual and shall not be funded or secured in any way.

When Chrysler filed for bankruptcy, 400 participants, including Chairman Lee Iacocca, lost their entire account balance, according to McDermott Will & Emery. While a “rabbi trust” was in place to help protect the plan, $200 million from the rabbi trust was used for company operations. Nearly eight years of litigation followed, resulting in still no recoveries for participants.

In short, the lessons we derive are (1) the risks of deferred compensation should be appreciated and actively managed – as the IRS allows, (2) rabbi trusts have their limitations, and (3) protracted litigation may not result in any meaningful recoveries.

For a comprehensive look at the risks of automotive companies, we recommend this list of defunct automobile manufacturers of the United States.

NCEO Conducts Webinar and Session on Single-Stock Risk Management

Atlanta Conference Draws Record 1,800 Attendees

In April, the National Center for Employee Ownership, the leading organization focused on broad-based employee ownership, conducted a webinar and conference session on the topic of single-stock risk management. One of the primary vehicles for broad-based employee ownership is the Employee Stock Ownership Plan (ESOP), which invests primarily in a single stock.

The webinar, entitled New Financial Strategies for ESOPs, took place on April 3 and can be accessed here.

The conference session, entitled Single-Stock Concentration Risk Management, took place on April 18 and can be accessed here.

For both events, Brian Yolles, CEO of StockShield, joined distinguished thought leaders in underscoring the importance of managing stock concentration risk. Thought leaders included Jerry Kaplan (Delaware Place Advisory Services), Peter Newman (Peak Wealth Planning), and Doug Pugliese (Alpha Architect).

Boston Conference to Focus on Financial Planning for Executives & Directors

Inaugural myStockOptions.com Event to Take Place on June 18, 2018

myStockOptions.com, the leading independent educational resource on equity compensation, will be conducting a one-day conference in Boston on June 18, 2018, entitled Financial Planning for Public Company Executives & Directors.

The conference is designed for professionals working with or seeking to advise executives, directors, and high-net-worth employees who have stock compensation and holdings of company stock.

Brian Yolles, CEO of StockShield, will be participating in a panel discussion entitled Strategies for Concentrated Positions in Company Stock. The session will discuss various approaches to mitigating the risks of concentration in a single stock, including hedging strategies (prepaid variable forwards, equity collars, protective puts, covered calls); exchange funds; and stock protection trusts.

The conference’s full agenda and registration information can be accessed here.