Rapid Collapse of Utility Underscores Need to Manage Risk

PG&E’s California inferno likely to cripple employees' retirement security

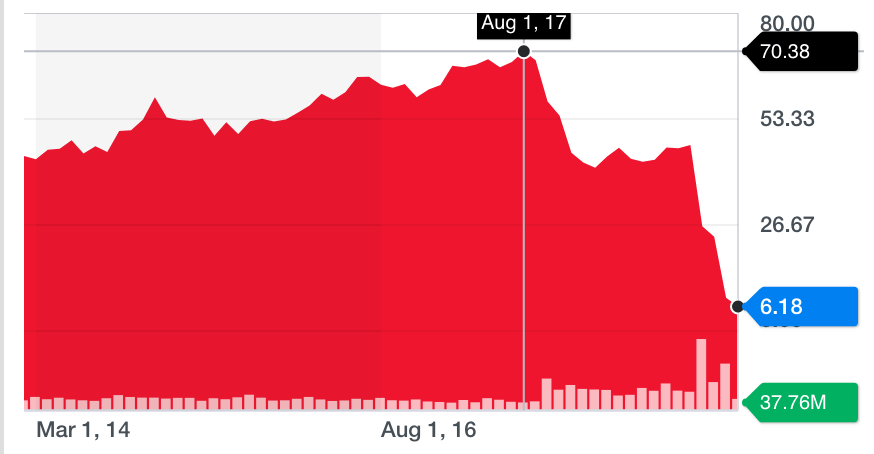

PG&E Corp. stock lost more than half its value yesterday and has traded today for as low as $5, down from its high of $70 per share in 2017 – a loss of more than 90% in 18 months.

In a regulatory filing, PG&E disclosed it will file for Chapter 11 bankruptcy protection. Three of its retirement plans – the Supplemental Retirement Savings Plan (SRSP), Supplemental Executive Retirement Plan (SERP), and Defined Contribution Executive Supplemental Retirement Plan (DC-ESRP) – are likely to experience substantial losses and may be worthless, as participants in these plans acquire status as General Unsecured Creditors (GUC).

PG&E’s financial problems began suddenly and accelerated dramatically after evidence pointed to its role in sparking a wave of historic wildfires in California. While the utility has still not been determinatively deemed the cause of any of the fall 2018 fires, investors have assumed that this is a foregone conclusion and abandoned the stock accordingly.

In an SEC filing, PG&E assessed the extent of its liability (predominantly legal liability resulting from civil lawsuits) resulting from the recent fires. It concluded that were it to be found liable for “certain or all” of the damages with respect to the 2017 and 2018 Northern California wildfires, the amount of such liability could exceed $30 billion – not including punitive damages, fines and penalties.

Even more remarkable, PG&E stated that even its estimate of $30 billion “is not intended to provide an upper end of the range of potential liability arising from the 2017 and 2018 Northern California wildfires, which management is not able to reasonably determine at this time. In certain circumstances, PG&E’s liability could be substantially greater than such amount.”

Over the last three months, PG&E stock has lost more than 80% of its value, causing the company’s valuation to crater to $2.8 billion from a peak of more than $36 billion in 2017.

Not a single analyst or market expert predicted such a precipitous decline. As recently as November 2018, Morningstar Equity Research re-affirmed its $53 per share fair value estimate and stated, “PG&E’s core business continues to track our 6% normalized growth outlook based on $6 billion of annual investment during the next few years. PG&E has substantial growth investment opportunities in distribution upgrades and disaster mitigation work following the new more-aggressive renewable energy standards in Senate Bill 100 and the implementation of SB 901.”

It has been widely believed in almost all corners of the investment community that utility companies are the most conservative stocks one can own, with large dividends and generally low risk of large losses given their conservative business model and recurring revenues.

There is no allegation or evidence that anyone at PG&E intentionally caused any of the fires. The company’s liability is solely based on negligence – and negligence with respect to merely a small percentage of its power lines.

One of the many lessons that can be learned from PG&E’s demise is that a few small negligent errors can decimate any company, no matter how large or long-standing or financially prosperous or seemingly “conservatively” operated and managed. Given how extensive the operations of most large companies today are, how many different business lines and geographical markets to which their reach extends, no executive or group of executives can ever ensure that their company never creates the type of liability that could cause its demise in a very short period of time. Human nature and behavior being what they are, negligent errors can never be eliminated. They can only be reduced, and one can only hope that the errors that ultimately result are not as catastrophic as those involved in the California wildfires.

StockShield designed its capabilities for those who take seriously the lessons offered by PG&E’s demise. Any company can at any time be brought to the brink of bankruptcy simply from a few careless errors on the part of any of its agents – or from events completely beyond the control of the company. Executives, retirees, and other employees who have worked and sacrificed decades of the very best years of their life could, within weeks, lose any realistic chance of realizing the financial resources they are otherwise rightfully due.